Global Service :3003120856@qq.com

A.4. Geographic location of the industry

The United States is the birthplace of household appliances. Edison invented the incandescent lamp in 1879, opening the era of household electricity. At the beginning of the 20th century, Britain, the United States and other countries successively invented electronic tubes (China Business Intelligence.2020. ).

From the region, 2019 sales volume of the three major markets of CPCA accounted for more than 80%, of which the Asian market accounted for over 50% (China Business Intelligence.2020 ).

In terms of retail sales, Asia, North America and Europe were the largest markets in 2019, accounting for 47.1%, 21.0% and 19.1% of the total respectively(China Business Intelligence.2020. ).

From the point of the global market, global household appliance market retail sales rose 8.6% in 2018, retail sales rose by about 2.9%, maintaining stable growth, with the Asia-pacific, eastern Europe, South America in developing market growth faster, India's home appliance market performed very well in the past year (retail sales grew by 7.5% year on year, retail sales rose 9.3% from a year), not only higher than the average level in the world, is also become an important driving force pulling the Asian market together with China (Zhiyan Consulting.2018.).

The world's home appliance production is mainly concentrated in North America, Asia and Western Europe, and 83% of the world's home appliances are produced in these three regions. Among them, 80% of North America’s production is concentrated in the United States and the U.S.-Mexico border; Europe is based on Italy as its manufacturing center; Eastern Europe is emerging with its cheap labor and its two advantages as close to the Western European market; the Asian market has huge potential and local labor prices are low. Become the largest home appliance production base in the 21st century(Shankar Bhandalkar/Debojyoti Das.2019.).

Figure 3. [Source: Data from Enterprice’s 2019 financial report or performance forecast, performance]

A.5. Profit trends

Since 2005, the price war in the household appliance industry has become increasingly fierce. Coupled with the impact of rising prices of raw materials and energy, although the sales of the household appliance industry have maintained a relatively high growth rate, they have declined compared with the same period last year. Downward trend. From January to October, the sales revenue of the household appliance manufacturing industry increased by 20.01 year-on-year, and the growth rate was 11.14% lower than the same period of the previous year. The total profit of the industry began to show negative growth in August, and by the end of October, the profit growth rate dropped to -11.52, and the home appliance industry entered a period of adjustment((Youjun Lu.2017).

China is now a big country in home appliance manufacturing and consumption. In a report released by South Korea, according to data, China-made home appliances have a global market share of 56.2% (Youjun Lu.2017).

China household appliances market will be taken as example to explore the household appliances industry revenue and profit's situation and tendency.

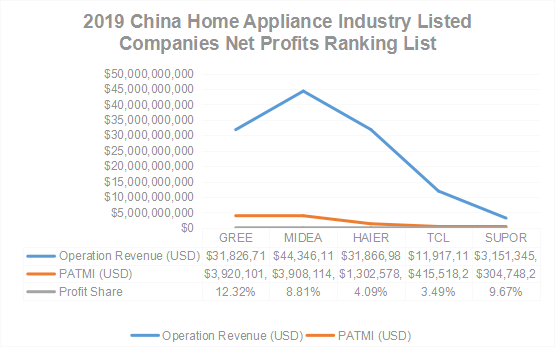

Here is the 2019 China Home Appliance Industry Listed Companies Net Profits Ranking List (Top 5). The TOP1 GREE PATMI up to 12% (Youjun Lu.2017).

Figure 4. Source: Data from Enterprice’s 2019 financial report or performance forecast, performance

In the mid- to late 1980s and the early 1990s when the home appliance industry was booming, almost all home appliance companies achieved rapid scale expansion driven by huge profits. However, since the mid to late 1990s, as the urban market has become saturated, the contradiction of oversupply of home appliances has become increasingly prominent. Especially in recent years due to fundamental changes in the sales channels and price determination mechanism of home appliances, as well as increasing pressure from international brands. The prices of products of most companies have dropped significantly, and the level of corporate profits has also been reduced year by year. This has ultimately led to continued decline in the profits of home appliance manufacturers, and some have even experienced huge losses.

The price of mature products must will go down, while the price of new technology home appliances is closely related to brand positioning and science and technology, and there is no way to decide. The glorious moment of profiteering in the home appliance industry has passed.

In 2019, the prices of main raw materials in the home appliance industry show a downward trend, reducing the pressure on the cost side to a certain extent. The industry competition makes the sales price of consumer products also have a downward trend, but the decline of the overall cost can not offset the decline of the price. In addition, the global labor cost increased in 2019, which makes the pricing of home appliances very difficult (Han Yang & Heng Yang. 2020).Profit would be less and less year after year.

After the COVID-19 had a global impact on the economy in 2020, the average cost of raw materials in the appliance industry rose to 15% in the spring of 2021 (Han Yang & Heng Yang. 2020). But till March 2021, all the sellers for electronic were still hesitating whether to increase the price or keep the price.It means that the manufacturers,they are cutting their profit,in order to keep price.For manufacturing enterprises, this year will be a very challenging year.

According to the cost of raw materials, the price provided by brand manufacturers to dealers is rising. In the same time,they have to lower the price to the new Internet channel that facing the end consumers and small batch buyers. Due to the strong bargaining power of consumer groups and the competition among brands, the sales price of market consumption is declining.

On the road of development, many domestic appliance companies already have a very important marketing network, which is the source of future corporate development and profitability. (to be continue)